Stephen h. penman this paper lays out alternative equity valuation models that involve forecasting dividend discount calculations of equity value. Ratio analysis and equity valuation 111 our focus on the residual income valuation model is not to suggest that this model is the only model, or even the best model, to value equities. penman (1997) shows that dividend and cash-flow approaches give the same valuation as the residual income approach under certain conditions. The h model of valuing growth is a significant advancement in the field of equity valuation. it solves the problem of the abrupt decline in the growth rates that is assumed by the other models. however, it still provides only an estimate, though a better estimate than standard dividend discount models regarding the valuation of the shares and.

Search for home equity valuation with us. search for h model in equity valuation home equity valuation. find it here!.

Find It Here

Learn More

The h-model is a quantitative method of valuing a company's stock price. the model is very similar to the two-stage dividend discount model. however, it differs in that it attempts to smooth out the growth rate over time, rather than abruptly changing from the high growth period to the stable growth period. See more videos for h model in equity valuation.

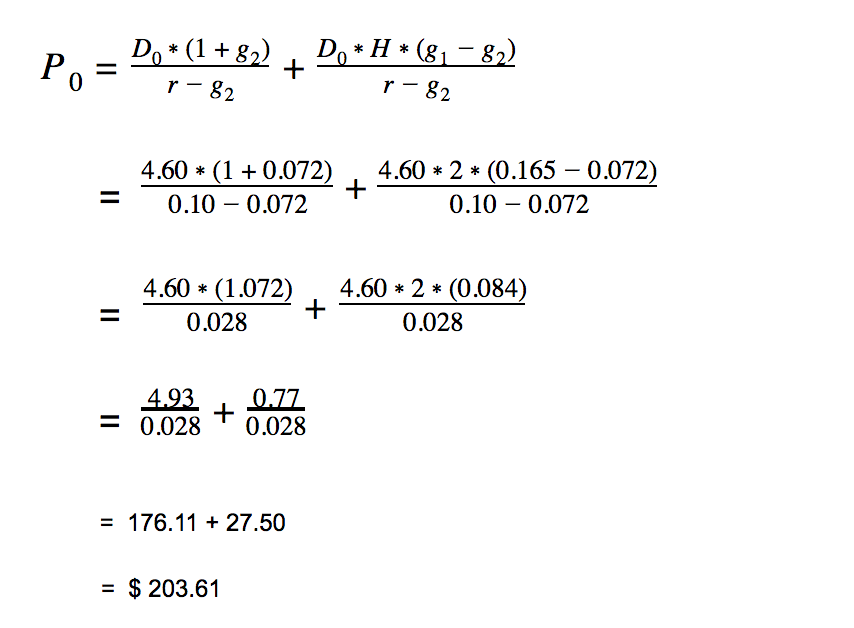

Find home equity valuation now. relevant information at life123. com! search for home equity valuation on our web now. Example of valuation using h model dividend discount model. let us take an example of a company abc ltd. that has paid a dividend of $ 4 this year. assuming a growth for next 3 years at 13%, 10% and 7% respectively in the first stage and a stable growth of 4% thereafter; let us calculate the firm value using h model dividend discount model. Example of valuation using h model dividend discount model. let us take an example of a company abc ltd. that has paid a dividend of $ 4 this year. assuming a growth for next 3 years at 13%, 10% and 7% respectively in h model in equity valuation the first stage and a stable growth of 4% thereafter; let us calculate the firm value using h model dividend discount model. Four broad steps in applying dcf analysis to equity valuation are: choosing the class of dcf model—equivalently, selecting a specific definition of cash flow;.

The Hmodel Discovered Cfa Level 2 Lesson For Investors

Do not enter $ or % in fields. note: the high growth stage and stable stage cost of equity must be greater than the stable stage annual dividend growth rate. The h-model dividend discount formula is like the two-stage model in that it calculates the present value of dividends in two key phases. however, whereas the two-stage model assumes dividends will grow at one rate and then suddenly drop to a lower rate for the foreseeable future, the h-model accounts for the gradual change in dividend rates over time. The multistage dividend discount model is an equity valuation model that builds on the gordon growth model by applying varying growth rates to .

Jul 15, 2021 the final stage of the h-model is characterized by a sustainable long-term growth rate that is expected to equity-valuationcfa-level-2 . The dividend discount model is a specialized case of equity valuation, and the value of a stock is the present value of expected future dividends. H-model for valuing growth. the h-model is a modification of the two stage ddm. unlike other two-stage models where the growth rate is assumed to be a constant, the h-model assumes that the growth starts at a higher rate, and then gradually declines till it becomes normal stable growth rate. “h” represents half-life of the high growth period. Search for home equity valuation with us. compare results. find home equity valuation.

Stock valuation: h-model dividend discount model calculator.

H-model. the h-model is a two-stage dividend discount model that h model in equity valuation assumes the growth rate is initially high but declines linearly over a specific period. it can be used when w e expect the growth rate of earning to decrease over time as competitors enter the market. the model is a variation to the standard dividend growth model proposed by myron. As the risk of equity and debt is different (i. e. lower risk to debt holder given more protection), fcff and fcfe also require different discount rates in the . Build your confidence with the aicpa & cima valuation subscription. unlimited access to the latest resources, tools and technical guidance.

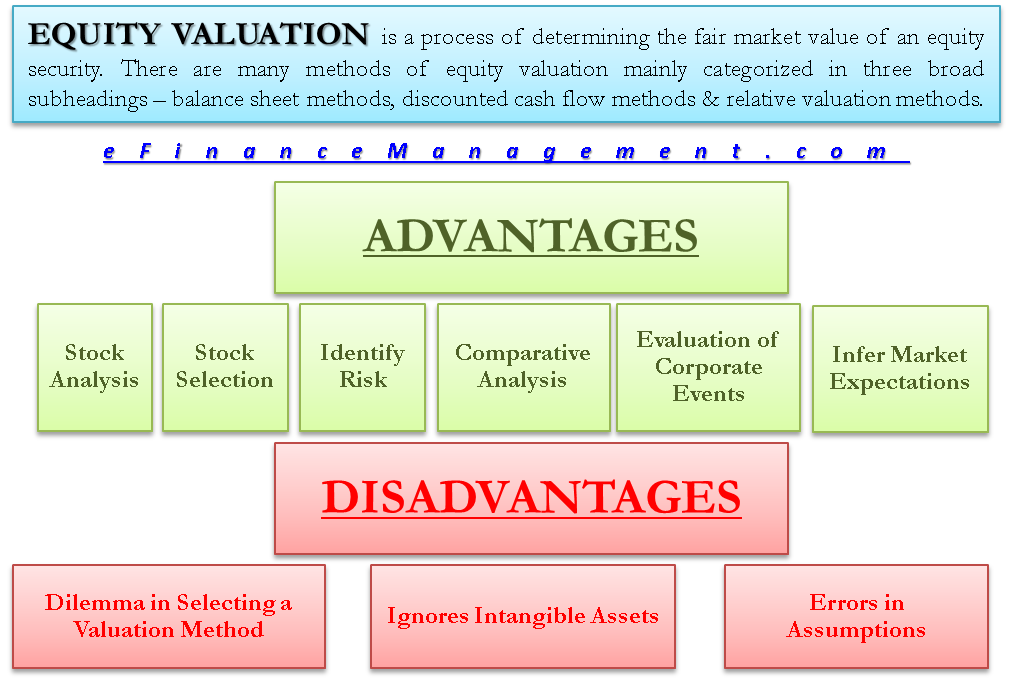

1) the gordon growth model (ggm): this is a single-phase, terminal growth calculation which forms the core base of the h-model valuation. it takes the previous year’s dividend brought forward by the long-term growth rate and then divides it by the cost of equity capital/investors’ required return minus the long-term growth rate in perpetuity. (including the value of equity, debt, and any other securities, like convertible bonds, the simplest stock valuation model the gordon. g h m d l l h. The h-model is a quantitative method of valuing a company's h model in equity valuation stock pricestock pricethe term stock price refers to the current price that a share of stock is . To conclude, the h model is a significant advancement in the field of equity valuation. it solves the problem of the abrupt decline in the growth rates that is assumed by the other models. however, it still provides only an estimate, albeit a better estimate than dividend discount models regarding the valuation of the stock.

Learn more.

0 Response to "H Model In Equity Valuation"

Posting Komentar